There is no doubt that travel insurance can claim a prime spot among the industries most impacted by the COVID-19. On the one hand, insurers have had to deal with an all-time high number of claims, resulting in hundreds of millions of dollars in cancellation and disruption payments to customers. On the other hand, the massive slowdown in international travel has resulted in the plummeting of travel insurance policy sales.

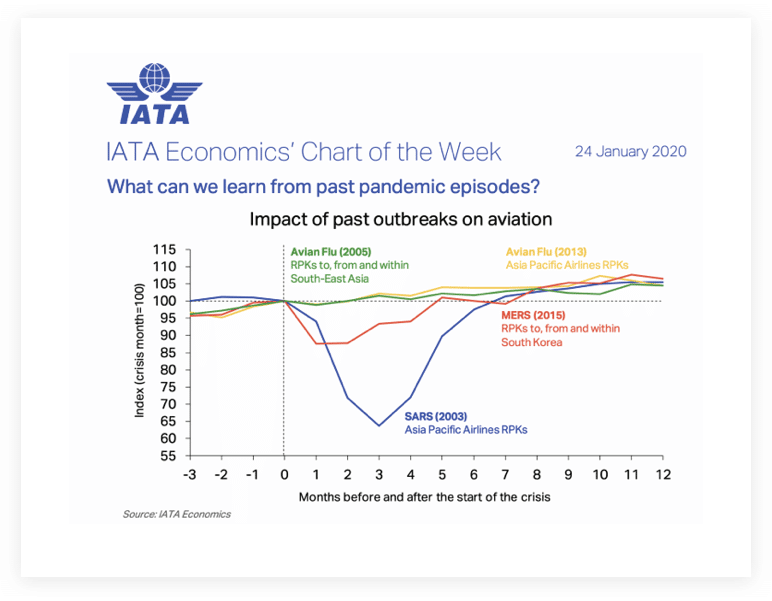

However, there are grounds for optimism. Nearly all experts agree that travel will eventually pick up. James Asquith, Forbes’ travel writer, notes that other disruptions like the SARS outbreak and the 2010 eruption of the Eyjafjallajökull volcano in Iceland didn’t prevent the speedy recovery of the industry. He comments that:

“in 2010, 20 European countries closed their airspace for nearly three months but passenger demand was able to bounce back sharply after.”

69% of US consumers stated they “can’t wait to start travelling again”, and 36% said they can already envisage going on a vacation this summer.

Travel operators are already reporting bookings for later this year. A survey conducted by BCG, the US management consulting firm, showed that 69% of US consumers stated they “can’t wait to start travelling again”, and 36% said they can already envisage going on a vacation this summer.

So, although the global travel insurance market has assuredly taken a big hit in 2020, its prospects are bright. In fact, a report by Global Info Research estimates that travel insurance premium revenue will rebound relatively quickly and is expected to overtake 2019 revenue by 2022.

This period of slower activity might be an ideal time for insurers to reexamine their operating models, and take the necessary steps to ensure they are ready for the resumption of mass travel that will undoubtedly occur when the pandemic finally subsides or when a vaccine is approved.

The COVID-19 crisis will have a long-lasting impact on the industry; it is actually likely to result in more appetite for travel insurance among the general public. “Now more people than ever are aware of travel insurance and how it could possibly help them,” reported Cheryl Golden, director of e-commerce at InsureMyTrip.com. “Every time we’ve had an event like this in the past, there’s been an uptick in travel insurance that sticks.”

Before 9/11, for instance, only 7% of US travellers purchased travel insurance. After the attacks, that figure more than doubled to 15%. Golden anticipates seeing a similar increase going forward, expecting the percentage of travelers purchasing insurance after the pandemic to reach up to 30%.

Insurers should keep in mind that this surge will be underpinned by two trends. First, consumers will expect increased flexibility from their travel insurance. This will translate into greater appetite for premium coverage and cancel-for-any-reason types of policies. In fact, this impact is already being felt this summer, with Cancel for Any Reason coverage increasing more than 680% compared to last summer, as reported by travel insurance comparison site, Squaremouth.com, who spoke with ten major travel insurance providers about how the sector is changing because of COVID-19.

Secondly, travelers will start paying more attention to the coverage provided by their policies for medical emergencies, as postulated by Khalid Sohail, Head Accident and Sickness at Zurich Insurance Canada. They will be particularly wary of falling sick while traveling and will expect easy access to excellent medical care.

Insurers must step up and adapt to these changing expectations. In the long run, they will not be able to keep customers satisfied and loyal to their brand if they do not adapt their offerings to improve the level of service delivered to their end users.

We have seen this throughout the history of the sector, most notably recorded in research by Morgan Stanley and BCG when, on the brink of digital disruption in 2014, their global research study suggested as many as 50% of consumers would switch to an insurer who provided online interaction.

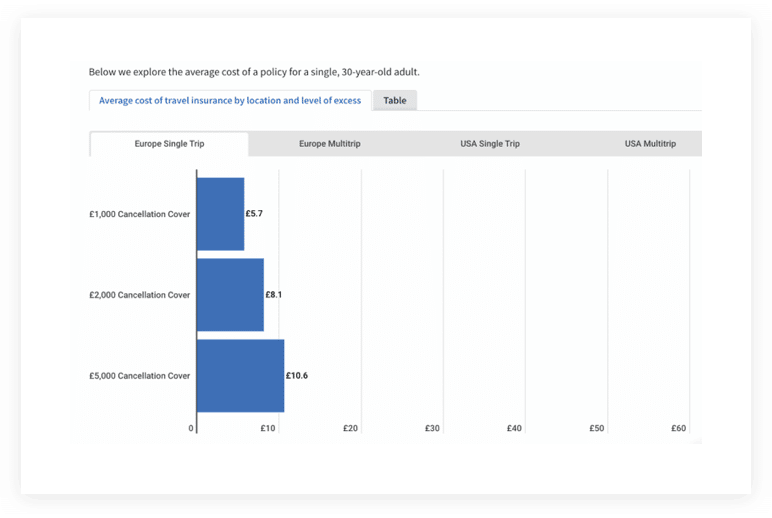

Data from finder.com, the UK’s fastest-growing personal finance comparison site

Beyond tackling the obvious consequences of the pandemic, insurers must reassess the very basic operating model of their industry in order to improve their loss and combined ratios in the longer term.

Travel insurance often operates in stark contrast to other lines of insurance. For one thing, it functions with relatively low premiums.

NimbleFins, a UK start-up offering data-driven personal finance advice, found that the average pre-pandemic cost for UK travellers for a single, week-long trip to Europe started from as little as £5. This increased for multiple trips to global destinations and was higher for older travellers and families.

One reason for this might be that travel insurance is not mandatory, resulting in consumers having a lower willingness to pay when it comes to their risk/reward tradeoff. Whatever the reason, low premiums mean that insurers must pay particular attention to their cost structure.

NimbleFins, a UK start-up offering data-driven personal finance advice, found that the average pre-pandemic cost for UK travellers for a single, week-long trip to Europe started from as little as £5.

Long before the start of the pandemic, market dynamics were already pushing insurers’ loss ratios upwards. A report by Market Research showed that UK travel insurance gross written premiums shrank by 10.8% in 2018 (driven by a decrease in the number of policies sold as well as a decrease in the average premium) while claims costs rose by 4.4%. Interestingly, this rise in claims costs was essentially driven by a 6.9% increase in medical costs. This is clearly a trend that insurers must tackle.

Another characteristic of the travel insurance industry is that the vast majority of policies are sold on a single-trip basis, rather than an annual basis. A report by Allied Market Research estimates that the single-trip insurance segment accounted for more than two thirds of the global travel insurance market in 2019. Selling policies on a per-trip basis means that there is no such thing as a renewal – each policy sold is considered “new business”. This contrasts with other lines of insurance where policies are often renewed on a yearly basis, by the same provider, with unchanged coverage. In the world of travel insurance, carriers must work hard to create and foster loyalty from their customers.

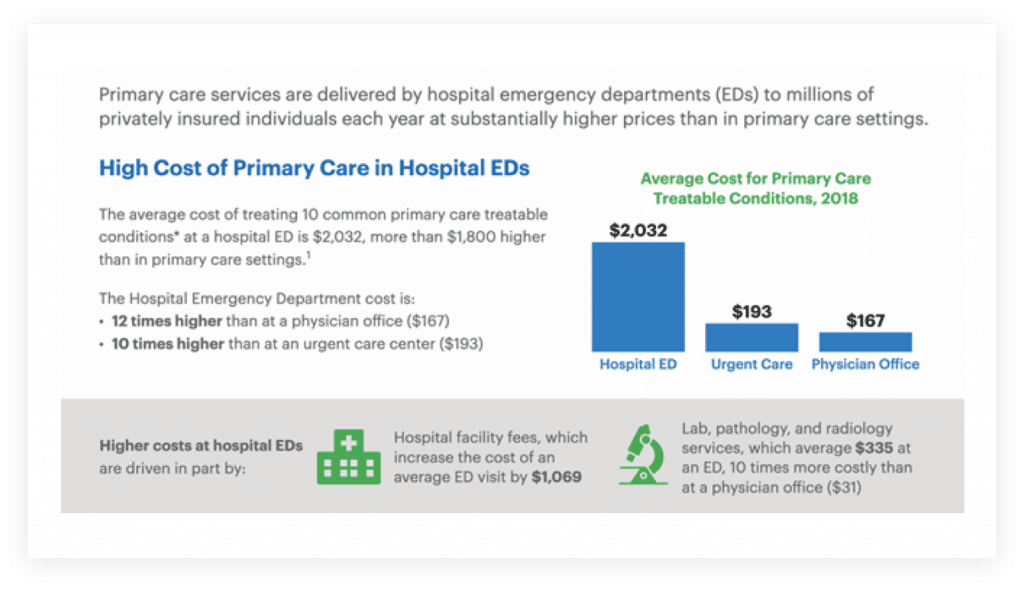

For instance, the average cost of an ER visit in the United States stood at $2,032 in 2019, according to a report by the HealthCare Cost Institute, versus an average of $167 for treatment by a private doctor.

Data from HealthCare Cost Institute’s The ‘High Cost of Avoidable Hospital Emergency Department Visits’, 2019

Offering customers with non-urgent cases outpatient clinics can therefore go a long way in improving an insurer’s loss ratio.

Controlling the costs of outpatient visits can also help reduce the loss ratio by keeping claims costs down – this can be achieved by building a network of local doctors who operate under an agreement with the insurer or a third party.

Insurers should not stop at lowering their loss ratio. Equally important is improving their combined ratio – which measures incurred losses as well as expenses in relation to the total collected premiums – for instance by streamlining claims management processes and consequently cutting back office costs.

Travel insurance providers keen to improve their quality of service for end users might explore innovative solutions that differentiate their offerings from those of competitors and improve engagement and proactiveness towards their customers. This will have the added advantage of helping insurers capture a greater share of the millennials market (a population that is generally less prone to purchasing travel insurance) – and which hold higher expectations when it comes to user experience and customer service than other segments of the population.

This is particularly true of the travel industry, as Adobe observed when surveying 1,500 US adults. Taylor Schreiner, director of Adobe Digital Insights, said of the findings: “When it comes to their travel experiences, [millennial] consumers want to be surprised and delighted. Anything that can save them time and effort, and make their stay more pleasant, is going to be key, as are personalized and customizable services that enhance the travel experience.”

Travel insurance providers have a once-in-a-generation chance to improve historically burdensome loss ratios by listening and adapting quickly to the new needs of modern customers. With demand for travel insurance set to rise as the aftershocks of the Covid-19 pandemic continue to be felt, embracing the development of new products and services can help insurers turn a challenge into an opportunity.

Air Doctor connects travellers to local private doctors when they fall ill abroad, preventing unnecessary, often frustrating, and potentially expensive hospital visits, and reducing pressure on emergency care. At the same time, it provides an additional revenue stream for local medical practitioners and reduces claims costs for insurers.

The Air Doctor app connects travellers with the most appropriate doctor for their needs – from a global network of more than 10,000 comprehensively-vetted practitioners that spans 48 countries and includes GPs, pediatricians, dentists, ophthalmologists, dermatologists, gynecologists, and orthopedic specialists as standard – to set up an online or in-person consultation. The service is free to travellers – Air Doctor takes a commission from the doctor after a consultation, and pays the balance through an insurer partner.

Founded in Israel in 2016, Air Doctor has raised $10.9 million in venture funding to date, through a $3.1 million seed round in 2018 and a $7.8 million Series A round in 2020. Investors include the AXA-backed venture builder Kamet Ventures and The Phoenix, one of Israel’s leading insurance companies.

The Phoenix – Israel’s second-largest insurance provider measured the impact of its partnership with Air Doctor over eight months from December 2018 to August 2019.

Air Doctor provided The Phoenix with a global medical network through which its travel insurance customers could access outpatient medical care abroad at no cost to them

The primary aim was to reduce reimbursement costs for The Phoenix by preventing expensive and often unnecessary inpatient stays at (emergency) care facilities

The secondary aim was to improve the experience for travellers by enabling them to search for doctors by proximity, medical specialism, and languages spoken, among other factors, in order to directly reach the most appropriate care

Air Doctor redirected 15 per cent of inpatient hospital visits to outpatient settings

The Phoenix recorded that 5 per cent of claims would have required hospitalisation without Air Doctor, resulting in an average cost of $2,660 per claim

Use of Air Doctor reduced the average outpatient claim from $171 to $150, including Air Doctor’s commission which was taken from the doctor’s fees at no cost to The Phoenix

By centralising invoicing and automating their processing, Air Doctor also managed to streamline payments for The Phoenix, reducing time spent on administrative tasks and, consequently, back office costs

Overall, there was a 14% reduction in outpatient to outpatient costs, saving over $1 million for The Phoenix and a 30% year-on-year policies increase which boosted The Phoenix’s market share

The total sample size was one million policies sold

Jenny is the CEO and one of the Co-Founders at Air Doctor. She spent more than 20 years at Intel, most recently as general manager of its manufacturing facility in Israel and before that in various engineering and manufacturing roles in Silicon Valley. Air Doctor is her second startup having previously founded electric vehicle company ElectRoad.